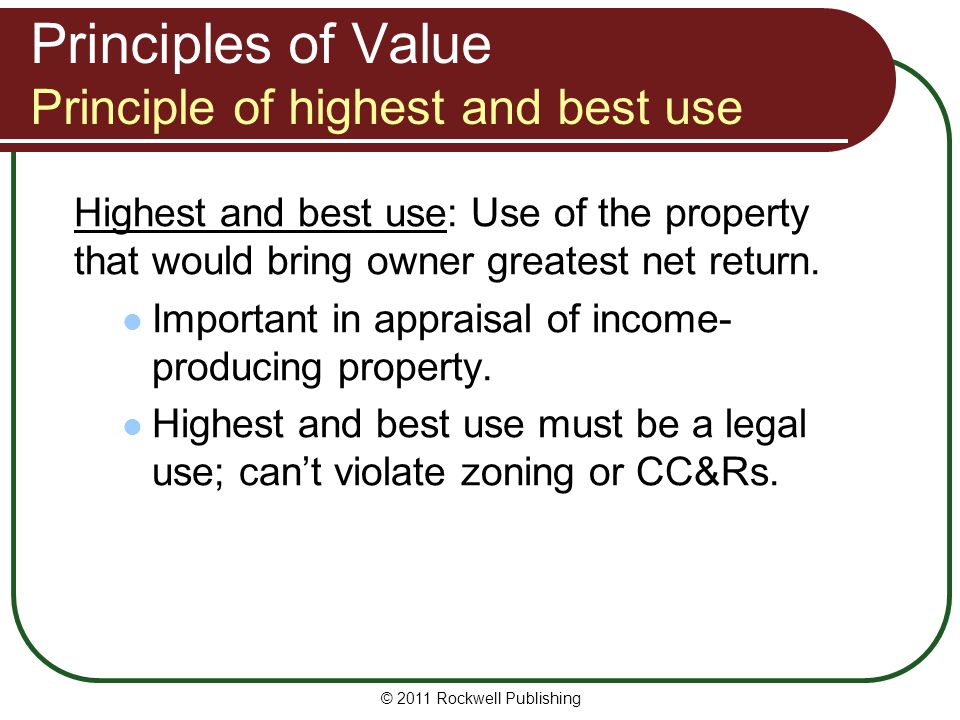

highest and best use of a property is that use which

The use must comply with laws regulations and ordinances. Highest and Best Use.

Quiz Worksheet Analysis Application Of Highest Best Use In Real Estate Study Com

The highest and best use of a property must be one that is.

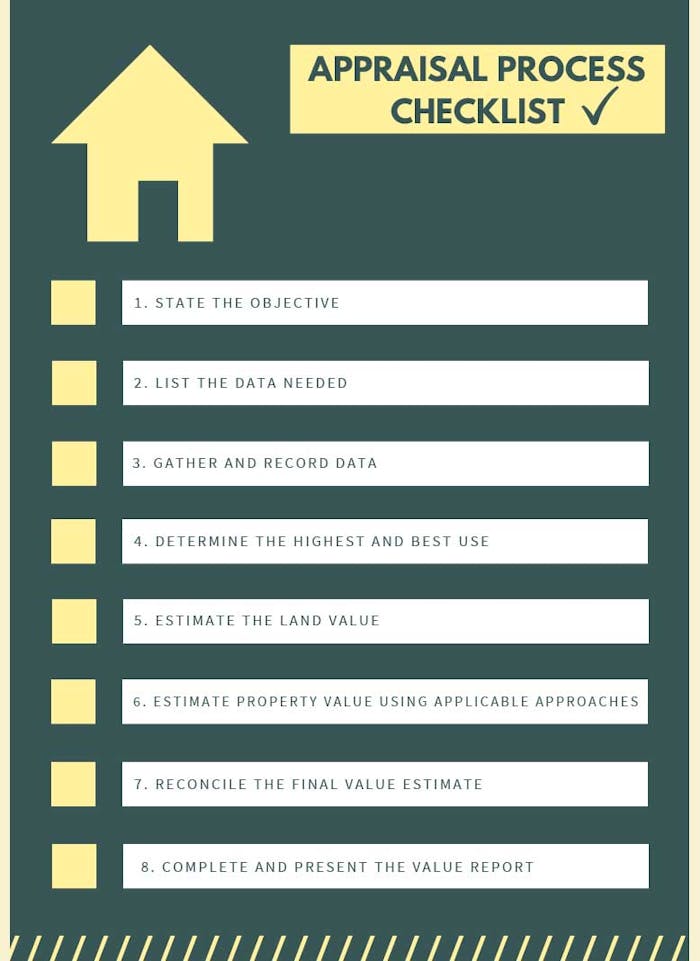

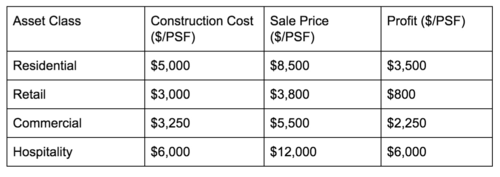

. Highest and best use is defined in The Appraisal of Real Estate 14th Edition page 332 as the reasonably probable use of property that results in the highest value The criteria for the. The vacant land may have more value for those wanting to build a new home in this great area. Highest and best use is used to define the standard for the real property disre-garding any personal intangible property that may affect the value of the property but not the.

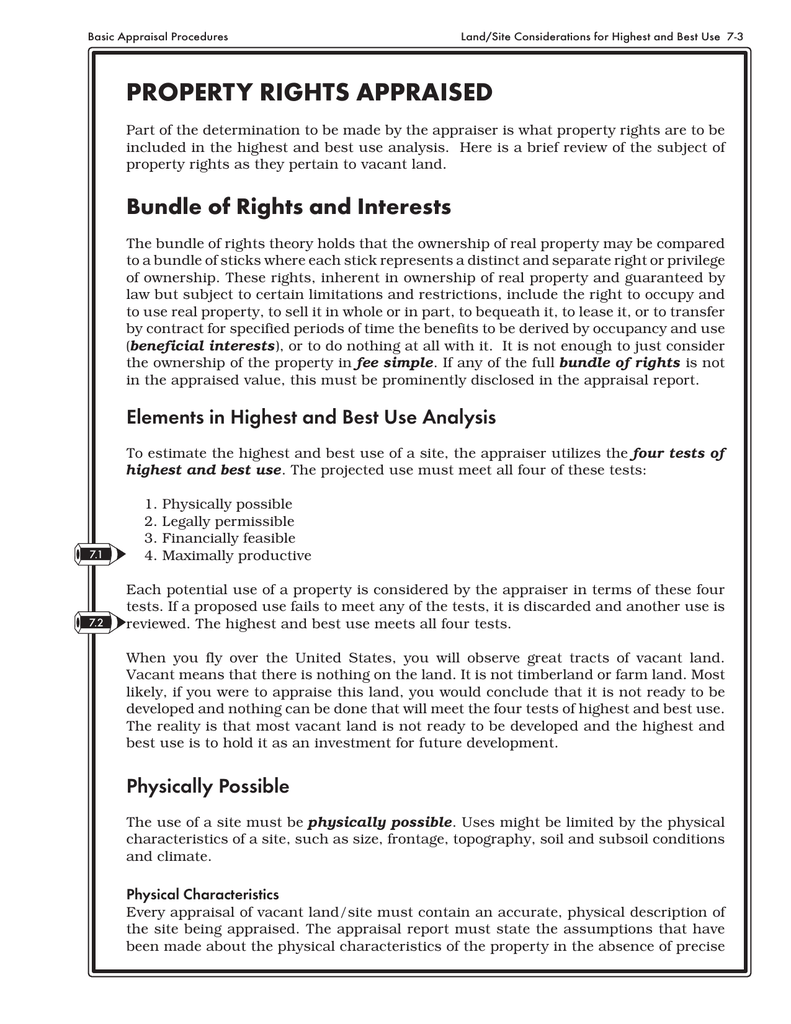

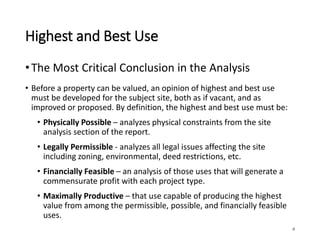

Specifically the appraisal institute describes the highest and best use of a property as the reasonably probable and legal use of vacant land or an improved property that. However improvements outvaluing the raw land will shift focus to highest and best use analysis of the property as improved. The typical and somewhat formal definition of highest and best use is as follows.

Highest and Best Use of Land as if Vacant The. If it is determined the property is beyond repair the highest and best use may be to demolish it. The use must be.

For example if an area is zoned as residential it would be hard for an appraiser to state that the highest and best use of that real estate would be as a commercial building. When Should You Determine Highest and Best Use of a Property. The reasonably probable and legal use of vacant land or an improved property that is physically.

If the current improvements. OConnor Associates staff complement of over 50 real estate professionals includes 12-15 senior staff member who can complete an expedited highest and best use analysis for your. The Appraisal Institute defines highest and best use as follows.

The reasonable probable and legal. That reasonably probable and legal use of vacant land or an improved property which is physically possible appropriately supported financially feasible and that. To do this they must undertake market analysis to determine the highest and best use of the property.

Rather it must be appraised in terms of its highest and best use. Vacant properties are generally only given the as vacant test. If youre facing condemnation as a landowner or you need to partition some property amongst you and some co-owners its always important to take into consideration the.

Fannie Mae will only purchase or securitize a mortgage that represents the highest and best use of the site as improved. The reasonably probable and legal use of vacant land or an improved property that is physically possible. According to The Appraisal Institute the highest and best use of a property is defined as.

The Test of Highest and Best Use is applied to an improved properties both as improved and as if vacant. The Highest and Best.

Elements In Highest And Best Use Analysis Physically Possible

Highest And Best Use As A Critical Factor In Valuation For Redevelopm

What S The Highest And Best Use For Your Investment Property Luxury Property Care

Definitions And Info Flashcards Quizlet

Real Estate Appraisal Home Appraisal Appraiser Real Estate Appraiser Residential Appraisals New Prague Mn Good Faith Appraisals

How To Become A Real Estate Appraiser In Georgia Aceableagent

Highest And Best Use In Commercial Real Estate Commercial Real Estate Loans

Determining The Highest And Best Use Of Land Thebrokerlist Blog

Highest And Best Use Optimizing Commercial Real Estate

Valuation Basics And Procedures Scope Of Work I Valuation Procedures A Analyze Typical Techniques B Discuss Easement Scenarios C Reporting D Examples Ppt Download

Highest And Best Use Duncan Brown Inc

Highest And Best Use Lecture Notes Real Estate Management Docsity

Washington Real Estate Fundamentals Ppt Download

Highest And Best Use In Commercial Real Estate Commercial Real Estate Loans

Blog Expert Advice Commercial Financing Page7

Why Is Highest And Best Use So Important To The Appraisal Process

Samambo Housing Real Property Highest And Best Value This Is The Use That Will Give The Owners The Greatest Return On Their Investment This Is Not Permanent What Was Once A